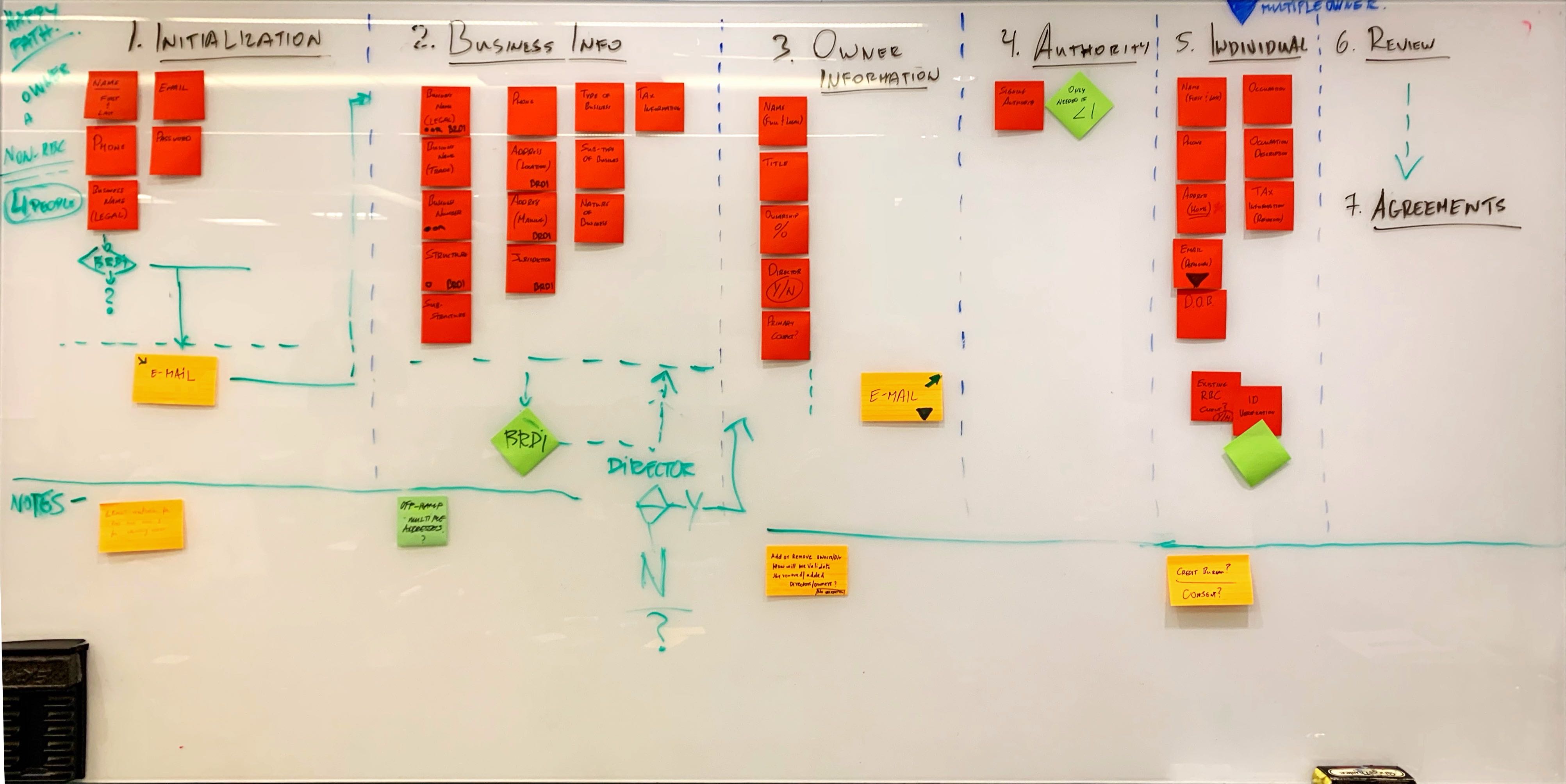

The data points that we collected as part of discovery did not seem to belong to any particular category. One of the first tasks I did was to perform an information architecture exercise and group these into logical segments that would provide meaningful structure to the whole onboarding flow.

Prior to acquisition by RBC, all types of business were allowed to become part of the platform. With RBC’s strict regulatory requirements, we identified that certain categories of business could not be digitally onboarded. This includes the following:

- Money Service Businesses,

- Depository Institutions,

- Non-depository Institutions, and

- Others